Commercial Real Estate Non-Bank Lending: The Drama of Equity and Debt

March 21, 2024

The photo of the poker chips was modified and the original photograph can be found here.

The Pillars of Property Ownership

Every real estate investor knows that property ownership is built on two pillars: equity and debt. Equity is your investment with your own dollars, or dollars from friends and family. This is also called a down payment. The second pillar is debt, also known as loan, borrowing, and leverage. In the current state of the market, there is stress between these two tectonic plates, which is leading to a reset to relieve this tension. An important player is the private debt market. So, let’s look at the relationships between these important players in commercial real estate.

Over my career I have come to realize that there is a great difference in point of view of those on the equity side from those who are on the debt side. The debt side get its regular payments, known as principal and interest. Equity players are the risk takers, getting all of the upside profit, but also with the risk of losing 100% of their investment. The debt side takes a lower risk profile, agreeing to a fixed rate of return if everything goes as planned, but their returns are lower because they are foregoing any upside. They just want their money back with interest, on time and in full. For the sake of simplicity, I am ignoring a lot of the nuances and complexities involved in lending, in order to illustrate my point.

The Drama of Equity and Debt

Let’s illustrate by way of a story. It’s San Antonio in the year 1883. Your name is Joe Equity and you are in a bar playing poker, in a saloon late at night. Your poker table has four seats, and the other three chairs are filled by the three Debt brothers. (This is to illustrate that a property is often purchased with 25% equity and 75% debt. Debt almost always has a much larger stake in real estate investment than does equity.)

Back to our story…

The three Debt brothers, making up 75% of the money on the table, play conservatively, mostly not to lose, not so much to win. You, on the other hand, take risks, draw to inside straights and are winning pretty handily, building the pile of cash in front of you.

Then, all of a sudden, Bad Bart swaggers through the swinging doors at the entrance to the saloon, and he is always trouble wherever he goes! (Bart represents bad things happening to your property, like loss of tenants, economic recession, pandemic, law suits, etc.).

The poker players all know trouble when they see it and jump up from the table. The three Debt brothers, being risk adverse guys, huddle behind you, in a row, so you are in front of all the players, putting you, Mr. Equity, in the first loss position. Well, Bad Bart spies your pile of cash on the table and he wants it all! He pulls out his revolver and points it at you, Mr. Equity! The possible scenarios are many:

1. You talk Bad Bart down. (Your negotiation and skilled maneuvering get you out of trouble)

2. The sheriff arrives. (Bad times resolve themselves from outside intervention, like the FED lowering interest rates, PPP loans, etc.)

3. Bad Bart shoots and you die, and Bart takes your cash, of course. The Debt brothers are sorry you got wiped out, but that’s life. Surprisingly, Bart only takes Equity’s money and the Debt brothers walk out with all the cash with which they started.

4. The bullet goes through you and wounds the first Debt brother. (That is, a write down of part of the loan)

But the Debt brothers survive and walk out the door to play poker again another day. I am certain you can imagine a number of other outcomes, too. The moral to our little story is that equity people and debt people view the world very differently.

We are seeing this Debt versus Equity allegory play out now in our commercial real estate playhouse, where banks are refinancing or restructuring loans which is called “kicking the can down the road.” Or they may be forced to foreclose on properties that are not sufficiently cash flowing and where the equity investor can’t or won’t put in more money. The lenders may also sell off their bad loans to a private lender who will restructure the deal, but usually to the detriment and destruction of the equity investors.

The Big Reset to the Next New Normal

So, we now find ourselves in the midst of the Big Reset. First, Covid brought about ultra-low interest rates. Essentially, money was free because borrowing rates and inflation were very low and the FED and our government were flooding our U.S. marketplace with loads of money available for lending on all kinds of real estate, which was inflating in value.

While this was necessary, to some extent, to off-set the trauma of shut-downs + work from home + social distancing + supply chain disruptions + limited travel, it would appear it was overdone as it produced very high inflation. The likes of which we have not seen since the OPEC oil embargos of the 1970’s. Now we are in the recalibration phase, where interest rates were raised at a historically unprecedented speed to quash inflation.

Is it working? We hope.

In this Big Reset to the Next New Normal many borrowers who bought or refinanced at ultra-low rates, now must refinance at much higher rates. A jump from 3.25% to 6.5% in your interest rate to refinance or if you have an adjustable-rate mortgage, doesn’t sound huge, but it means your interest expense just doubled.

Then, add in higher property taxes and insurance costs, and you discover to your misery that your property no longer cashflows. Banks will only refinance if their debt-service-coverage ratio shows you can pay your mortgage without problems; specifically, your net operating income must be 25% higher than your mortgage payments.

This means you will have to add extra equity into the deal to keep your property. Consider also that rising capitalization rates have brought values down by as much as 20%, so your bank’s new appraisal is now lower than your current balance. Ouch!

But the good news is that values appear to be bottoming out. The Green Street Commercial Property Price Index® was unchanged in February. The all-property index—a measure of pricing for institutional-quality commercial real estate—is down 7% over the past year and 21% since its March ’22 peak. Yet a rebound in value is probably a year or more in the future, as interest rates may not be coming down till late in 2024.

Bankers and the Others

How is this affecting the credit markets? First, some facts about banks and commercial real estate (CRE) lending. The estimated size of the entire commercial real estate credit market is $5.8-trillion, including about $1.1-trillion in government sponsored entity loans, GSEs, like

Fannie Mae and HUD. According to The Real Estate Roundtable, an industry trade group, banks hold about 45% of all CRE at about $2.3-trillion which includes about $650-billion in construction loans. Among the banks, big banks are more diversified with only about 12.5%, of their assets in CRE, while the community and regional banks are more like 38% in CRE.

The rest of the credit market is in Collateralized Mortgage-Backed Securities (CMBS) which hold loans typically ten years in length (about $1.3-trillion), and Collateralized Loan Obligations (CLOs) which are managed pools of short term, 5 years or less, non-investment grade bridge loans (nearly $1-trillion). It’s a truly a huge, complex marketplace and it is performing a critical role in our country’s economic growth. With banks at 45% of CRE and 55% in other entities, you can readily see that the position of banks within CRE lending has diminished in the past 15 years and the non-bank lenders are playing a major roll now.

Non-Bank Lending Rises

The private or non-bank market began in the early 1990’s and grew to about $280-billion by 2007, before the 2008 Great Financial Crisis. Banks were forced to become more conservative as a result of the GFC, and one interesting result is that this brought about a whole new industry in non-bank lending, which is outside the bank regulators overview.

It is often given the conspiratorial label “shadow banking,” however, it is the private marketplace rising to satisfy the need for capital the banks were no longer able to supply. The private lending industry has grown to over $1.5-trillion in 2022 and has been a lifeline to small and medium sized U.S. businesses.

The private lending industry has grown to over $1.5-trillion in 2022 and has been a lifeline to small and medium sized U.S. businesses.

An example is IRC Capital Residential, Ltd., which Investment Realty Company started in 2009 as a private lending fund to address the need for interim construction loans for small homebuilders in the San Antonio area.

The initial $2-million fund has now grown to $22-million and reaches not only San Antonio but also the Austin, Houston and Dallas markets. IRC CapRes has the flexibility to customize loan programs for small builders that are out of the range of community banks. This fund has provided over $300-million in construction loans for about 1,100 homes.

Because of the current credit squeeze, Wall Street has raised tens of billions of dollars in equity and debt opportunity funds to swoop in when banks want to disgorge troubled loans. Private debt funds are not heavily regulated and their investors are primarily pension funds, life insurance companies and high net worth investors, who are supposedly better able to evaluate their risks and to absorb potential losses.

Their managers are highly skilled real estate operators who can make more entrepreneurial decisions and can better facilitate work outs than what bankers are allowed to do. This may be by foreclosure or purchase of the loan from the bank.

They may buy the bank loans anywhere from par to a 50% discount. It would be expected that the old owner/borrower will have to surrender some or all of their equity to the private lender to keep their property. It might come in the form of a bridge loan, which is a short term, high interest loan where some equity or future upside are traded for the refinancing that keeps the transaction in play.

The Many Categories of CRE

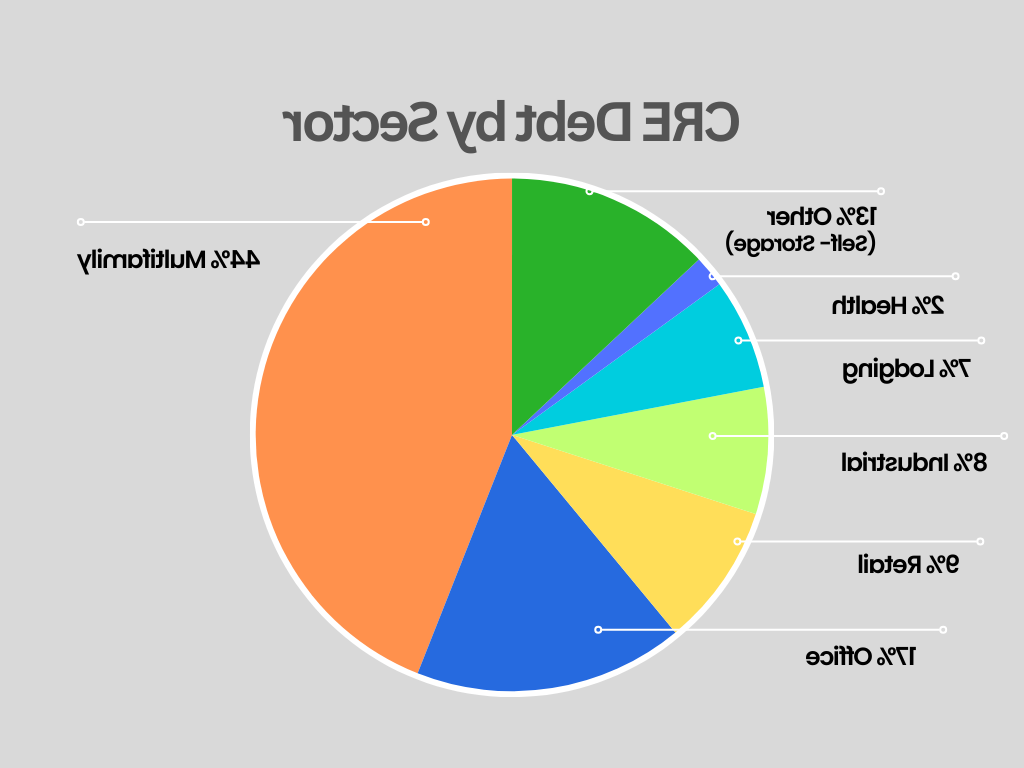

CRE has many different sectors, each with its own particular characteristics. To give you an idea of how large each category is, here’s a breakdown by percentage of debt amounts.

Information in this chart derived from CCIM conference speaker Blake Hastings, Sr. VP of SWBC.

Office

Let’s take office buildings, as an example, since they are currently the most distressed of all the property types. The pandemic and work-from-home policies have only partially reversed. Office occupancy rates are near historic lows around 87% but actual physical occupancy is much lower, maybe around 50%. This is tracked by cell phone activity.

The Next New Normal has become a work week where employees work-from-home on Monday and Friday and in the office on Tuesday, Wednesday and Thursday, but this is still in transition. This means the rents supporting office building values are shaky. And thus, the loans invested in office buildings are backed by questionable equity, which may have disappeared in the past couple of years. And then, the loans for these buildings are coming due, the lenders don’t want to foreclose in the soft market, but can’t refinance either. Banks are the most at risk because they are very heavily regulated, since they handle the checking accounts and savings of ordinary retail customers.

Fortunately, office building loans are not a very large portion of most banks portfolios and the troubled loans are a small percentage. Experts say our system can handle this stress without major disruption, but still many office building loans will need restructuring of their debt or their equity or both.

Debt, Equity and the Capital Stack

To summarize, we see that debt is usually a larger portion of the capital stack than equity. However, debt is risk adverse, while equity takes, hopefully, only reasonable risks, because equity is first to loose before debt is at risk. Then, we looked at the composition of the debt markets seeing that non-bank debt is now a bigger player in the commercial real estate marketplace than is bank debt.

We are moving forward to the Next New Normal, which may still be a year in the future when the interest rates settle in around 5.5% to 6%. Rates will remain higher because they were artificially depressed by the pandemic and the FED; then artificially higher, because of the FED. The dynamic tension between Joe Equity and the Debt Bros. will remain but like all mutually dependent relationships, they will work through the rough spots with accommodations from both sides and then move forward to sunnier days ahead.